How to Monitor Spending and Manage Project Budgets Properly

Do not lose money on your projects. Take the opportunity and have a look with us at the basic principles of financial project management and control your income, expenses and the entire project budget.

A project manager’s essential skills include the project’s finance management and making sure that the project stays within the sent budget. In the end, compliance with the financial plan is often also one of the most frequent criteria for assessing the project’s success.

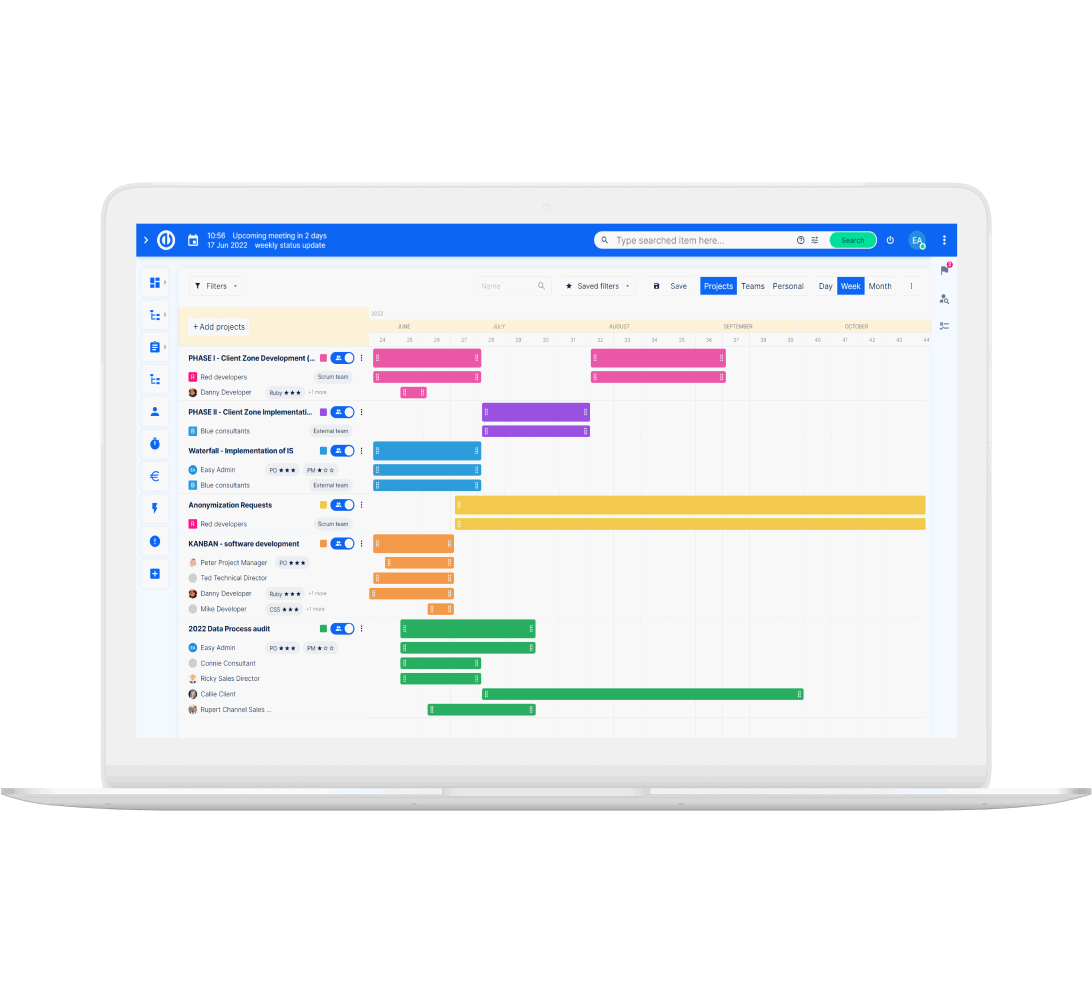

Individual expenses will gradually “eat away“ from the total amount of money you have available for the project. Monitoring of income, expenses, and overall cash flow is therefore essential for the proper administration of the entire project budget. If you are in charge of multiple projects simultaneously, incl. their budgets, then it is necessary to monitor the financial status of the entire project portfolio.

5 steps for project’s financial planning

To avoid wasting your project budget and ultimately making the project fail, we have prepared steps for your project’s financial planning.

Selection of Tools

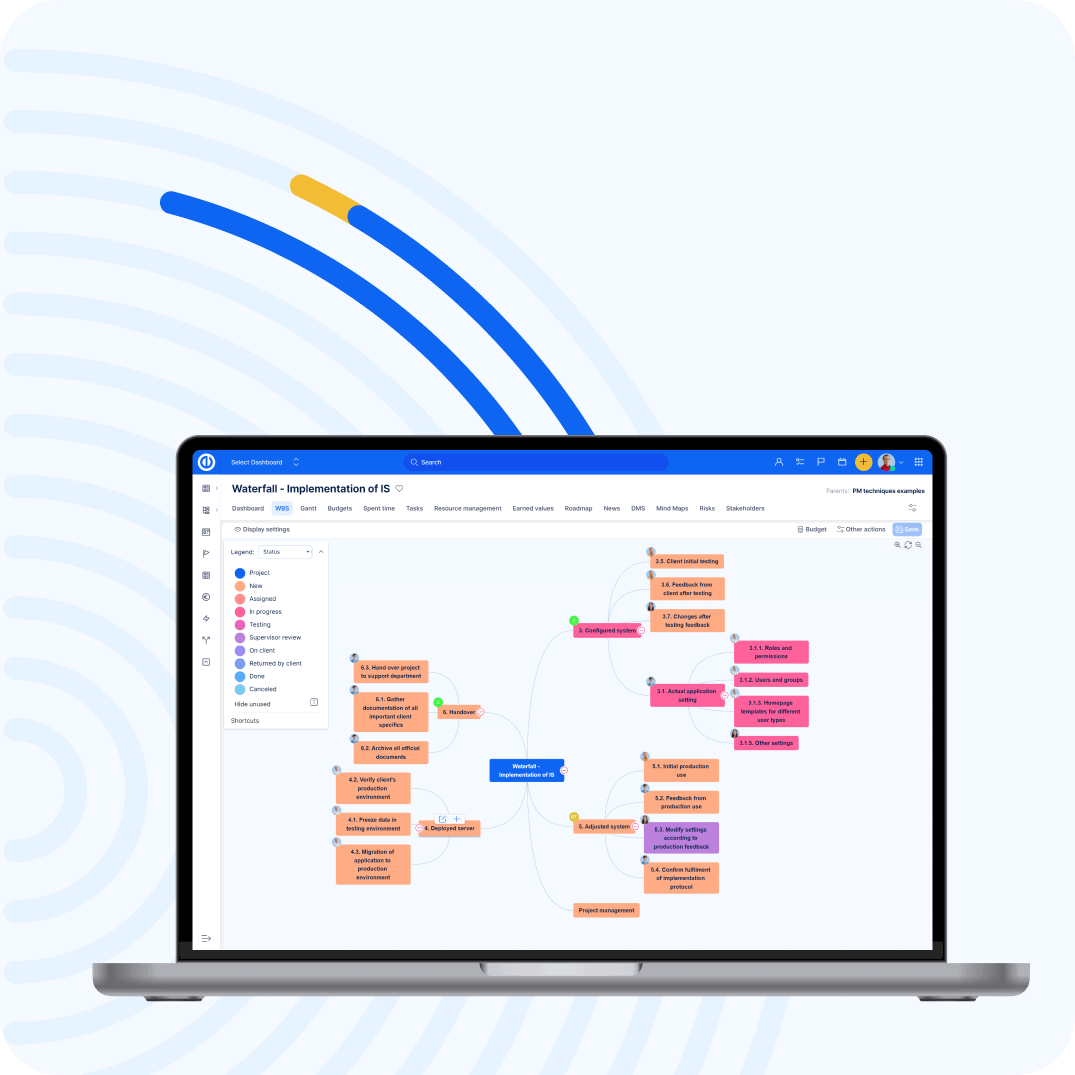

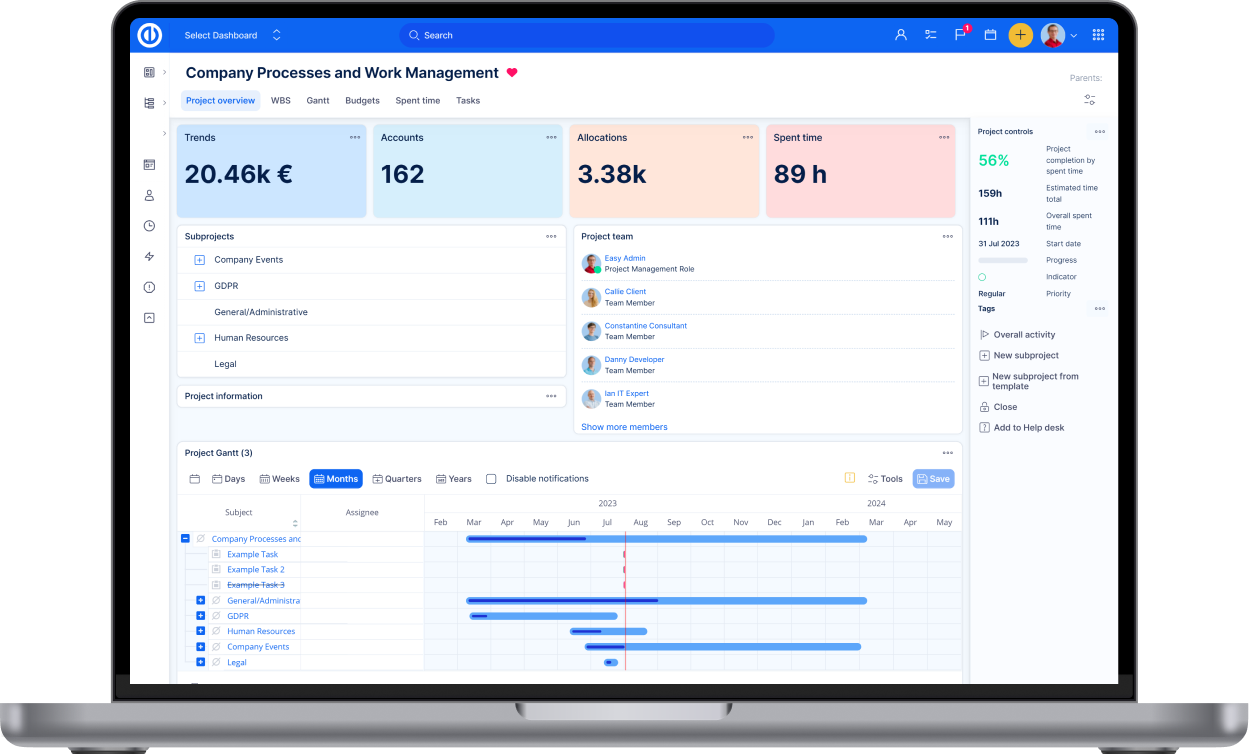

First of all, it is necessary to identify one tool that will serve at the center point of your project’s finance management. Not only in the light of the events of 2020, but you also want to have online access to this tool so that you and your team can add expenses in real time from anywhere, and not forget anything. The ideal scenario is to use directly the software that you are already using use to manage the project itself. For example, in Easy Project you have direct access to dedicated panels for budget, payroll, and invoices or cash flow.

Identification of Expenses

However, the software alone will not suffice if you do not thoroughly identify all the items that belong to your budget. To do this, we recommend using CBS, or Cost Breakdown Structure, to help you transparently map all components of your budget. No cost or expense may be missing from CBS, otherwise, you are facing the risk of errors that may affect the entire project planning substantially.

Budget Creation

Once you have an overview of anticipated income and expenses, you may proceed with the actual planning, i.e. budget creation. When indeed all fixed and variable costs are identified, you get an idea about the project’s approximate value and sums you may or may not reach.

Monitor the Progress

During the project, you or the authorized person must monitor the real development of finances and compare them with the original budget. You, therefore, need to work with profit and loss statements and monitor your cash flow. In addition, for cases where you use separate accounting tools for monitoring and registration, we have simplified your work via the integration of these tools into Easy Project.

Most importantly, bear in mind that you can only prevent potential budget overruning by monitoring the development of your costs and you will know immediately if part of the project is out of control.

Evaluate

As usual, do not forget to do a retrospective after your project ends. Comparing the resulting expenses against the original plan will give you an idea about the accuracy of your planning, which you can improve in other projects. You can also track which parts of the project deviated from the plan the most and determine whether this happens repeatedly. In short, utilize the collected data to the max.

Related articles

How to Monitor the Performance of Your Team Members in the Home Office Era

Project decomposition: Why should you do WBS?

It’s tempting just to start entering tasks into your plan and skipping the Work Breakdown Structure (WBS), but you may be in for a surprise when you start to execute your plan.

What about stopping for a while and considering the benefits of project decomposition?

Ready to manage your projects no matter what this year brings? Easy.

Get all powerful tools for perfect project planning, management, and control in one software.